AiNetProfit® Manual

Requirements

Mac version Requires: macOS 12 Monterey or later (64-bit Intel or Apple Silicon), .NET 9 Runtime (via .NET SDK or runtime installer), 4GB RAM, 200MB available disk space, Internet connection for updates.

Zero-Training AI™ (Patent Pending)

Bill SerGio invented Zero-Training AI™

as a real-time decision interface to the older AI requiring data and training.

It is an AI technology that allows

AI to be created and deployed without the need for any models or training data.

This new AI requires NO data and NO training.

Read All About It Here

Our iPhone & Android Mobile App

|

Our AiNetProfit® iPhone & Android Mobile AppOur Mobile App is 100% FREE...

Our mobile app will allow you to scan your receipts instantly and send them securely

to our accounting software through our new AI File Exchange System.

This system ensures your data is encrypted end-to-end and processed by our AI to automatically extract,

categorize, and post transactions with zero effort from you.

You can also watch our business videos for tips and strategies

— or even upload your own videos that will play not only on the app but also on your

TV at home through our smart streaming integration. And we have included thousands of HD movies

to help you relax and enjoy life.

Designed as your all-in-one AI-powered business companion and AI Assistant.

Expect smart reminders, instant syncing with our desktop software and you aos have

control with voice commands.

|

Introduction

We decided to create an EASY-TO-USE accounting application takes full advantage of what AI and Neural Networks can do for any business large or small.

For modern e-commerce sellers, cash-based accounting and ad performance tracking are far more useful and what our accounting app is focused on, namely, helping YOU to make more PROFIT.

This app is for modern e-commerce sellers who need reports to file their taxes which we included and features to help market their products.

Modern Web-Based Companies

Don't Use Accounts Payable or Receivable

Companies selling products on platforms like Amazon or their own websites do NOT need traditional Accounts Payable (AP) or Accounts Receivable (AR) . Here's why:

✅ Why Traditional AP/AR Aren't Needed

1. They Don't Sell on Credit (No AR Needed)

- Traditional AR tracks invoices where customers pay later (e.g., Net 30 terms).

- Web businesses get paid instantly via credit cards, PayPal, Amazon, etc.

- There's no need to manage invoices or collections — sales are immediate.

2. They Don't Receive Invoices from Suppliers (No AP Needed)

- Many expenses are prepaid: ads, manufacturing, shipping, etc.

- No vendor bills to track — just record the payment as an expense.

✅ What These Companies Need Instead

Instead of AP/AR, modern businesses need tools to track and PREDICT advertising performance and sales attribution which we will be adding over time in the development of this application .

| Table Name | Description |

|---|---|

| Zero-Training AI™ |

We will be adding our proprietary Zero-Training AI™

as a real-time decision interface through this application. It is an AI technology that allows

AI to be created and deployed without the need for any models or training data. |

| Microsoft ML.NET Enterprise-Grade AI | A production-ready machine-learning framework from Microsoft that enables enterprises to build, deploy, and integrate scalable AI models directly into .NET applications using C#, with strong performance, security, and long-term support. |

| Predictions & Decisions |

We combine our proprietary Zero-Training AI™

for Decision Making with the power of our proprietery AI trained

neural networks in Microsoft ML.NET for amazing results. This allows us to predict ad performance as well as calculate which ads to buy and the maximum dollar amount to spend on each ad to achieve a net profit BEFORE you buy that ad! |

| AdSources | Tracks ad campaigns by source (e.g., Google, Amazon, Facebook) |

| AdExpenses | How much was spent on each ad or campaign |

| SalesAttribution | Sales generated by each ad or campaign |

| Payouts | When Amazon, Stripe, etc. paid the business and how much |

| ROIPerAd | Calculated metrics like gross profit and return on ad spend (ROAS) |

Why SaaS Is Very Bad for Consumers

AINetProfit® is 100% FREE!

Our FREE Ai Accounting Software allows users to own their copy, providing greater control and alleviating risks and problems associated with the SaaS model. READ THIS: Forbes Article

SaaS (Software as a Service) is way of delivering software over the internet where users are forced to pay a subscription fee to access the software, instead of buying and owning the software. The software runs on the provider's servers and is accessed through a web browser.

In our opinion, SaaS presents serious drawbacks for consumers and is downright despicable:

- Recurring Costs: SaaS models often involve ongoing subscription fees which means that consumers NEVER STOP PAYING for the use of the software. We say to hell with compnies using the SaaS model.

- Data Privacy Concerns: Storing data on external servers in the cloud managed by third-party providers can raise issues regarding data security and privacy, especially if the provider experiences breaches or mishandles data. NEVER PUT YOUR FINANCIAL DATA ON THE CLOUD !!!

- Dependence on Internet Connectivity: Accessing SaaS applications requires a stable internet connection. Service disruptions or limited connectivity can hinder access to essential tools and data.

- Limited Control and Customization: Consumers may have restricted ability to modify or customize SaaS applications to fit their specific needs, as they do not own the software.

- Vendor Lock-In: Migrating from one SaaS provider to another can be challenging due to data portability issues and compatibility concerns, potentially limiting consumer choices.

Our FREE Marketing Course

At the heart of any successful Internet-based business is marketing.

Without effective advertising, even the best products go unnoticed. That's why we

offer a free course on marketing to help you succeed.

Download Our FREE Software and Get Our FREE Marketing Course!

American Banks

Why We Only Support American Banks

While there isn't a widespread consensus advocating that companies should exclusively use American banks, several practical and regulatory factors often lead businesses operating in the U.S. to prefer domestic banking institutions.

Regulatory and Operational Considerations

For companies conducting business in the United States—especially those involved in processing U.S. payroll, managing taxes, or seeking federal programs—having a U.S.-based bank account is often essential. The U.S. Department of Commerce notes that nearly all U.S. payroll providers require a U.S. bank account to process payroll. Additionally, certain federal programs mandate that a company maintain a U.S. bank account for a specified period to be eligible for assistance. [Source: trade.gov]

Accounting and Compliance Benefits

Utilizing American banks can simplify accounting processes, ensure compliance with U.S. financial regulations, and facilitate smoother interactions with domestic financial systems. This is particularly relevant for businesses that rely on U.S. accounting standards and need to align with local financial practices.

Our Conclusion

While there's no explicit directive for companies to use only American banks, the combination of regulatory requirements, operational efficiencies, and compliance considerations often make U.S. banks the practical choice for businesses operating within the United States.

Double Entry Sucks

Why We Don't Use Double Entry Bookkeeping

In today's rapidly evolving financial landscape, the traditional double-entry bookkeeping system is increasingly viewed as outdated. Modern accounting software automates transaction recording and real-time financial analysis, rendering the manual, dual-entry process redundant and useless. The double-entry system's complexity demands specialized training and is time-consuming, making it impractical for small businesses with limited resources and of NO value for larger companies. Moreover, its rigid structure can hinder adaptability in dynamic markets. Some critics argue that the persistence of double-entry bookkeeping ONLY benefits accountants and NOT businesses, where it perpetuates a reliance on professional services for tasks that could be simplified through technology. This perspective implies that the system's continued use may serve the interests of the accounting profession over those of business efficiency.

Developers

Our C# .NET 9 Electron.NET AI Business App

- One codebase, two desktops. Razor + Electron.NET gives a single UI stack that runs on Windows and macOS with the same look/behavior.

- Familiar stack & libraries. You keep using C#/.NET for everything—DI, logging, async, EF/ADO.NET, SQLite/SQL Server clients—no context switching.

- Offline-first with web-grade UI. Razor views + local assets give a responsive “web app” UX without needing a server connection.

- Easy packaging & updates. Electron.NET supports Windows (NSIS/MSIX) and macOS (.app/DMG) packaging, code-signing, and auto-update flows.

- Security & policy control. You can enforce CSP, sandbox renderer processes, and avoid bundling Node integrations you don’t need.

- Performance & footprint. .NET 9 trimming/AOT can reduce startup time and size versus shipping a browser + Python runtime stack.

- Native integrations. Access OS features (menus, file system, tray, dialogs) while keeping UI in Razor/Bootstrap/DataTables you already use.

- Deterministic builds. NuGet + SDK-style projects are repeatable in CI/CD; fewer surprise breakages than mixed runtimes.

Why ML.NET Instead of Python

- Single-language deployment. No Python runtime to ship, no venv/conda, no pip dependency drift. Your installer stays clean.

- Tight C# integration. Models are strongly typed; training/inference runs inside your app domain with your DTOs and services.

- Works fully offline. Training and prediction happen on the client with no external services—important for your accounting app.

- Good fit for your tasks. Classification, anomaly detection, forecasting, and AutoML are built-in and sufficient for categorization, fraud/flagging, and simple time-series.

- Production reliability. .NET’s tooling, debugging, and profiling are first-class for your team; fewer ops headaches than managing Python on end-user machines.

- Distribution & compliance. Many enterprise desktops allow .NET apps but restrict Python; ML.NET avoids that policy friction.

- Interop when needed. You can import/export ONNX and call out to TorchSharp if you ever need deeper models—still without Python.

We are evaluating a DAL layer to support additional databases such as MySQL and SQL Server. This would be an optional connector so you could point the app at external databases if desired. No decision has been made yet; we’re still assessing complexity, performance, and maintenance impact.

We are also considering publishing portions of our source code for community review and contribution. Again, no final decision has been made on this yet.

-

Windows:

C:\Users\<YourUser>\AppData\Roaming\AiNetProfit\Databases -

macOS:

/Users/stargate/Documents/Library/Application Support/AiNetProfit/Databases/

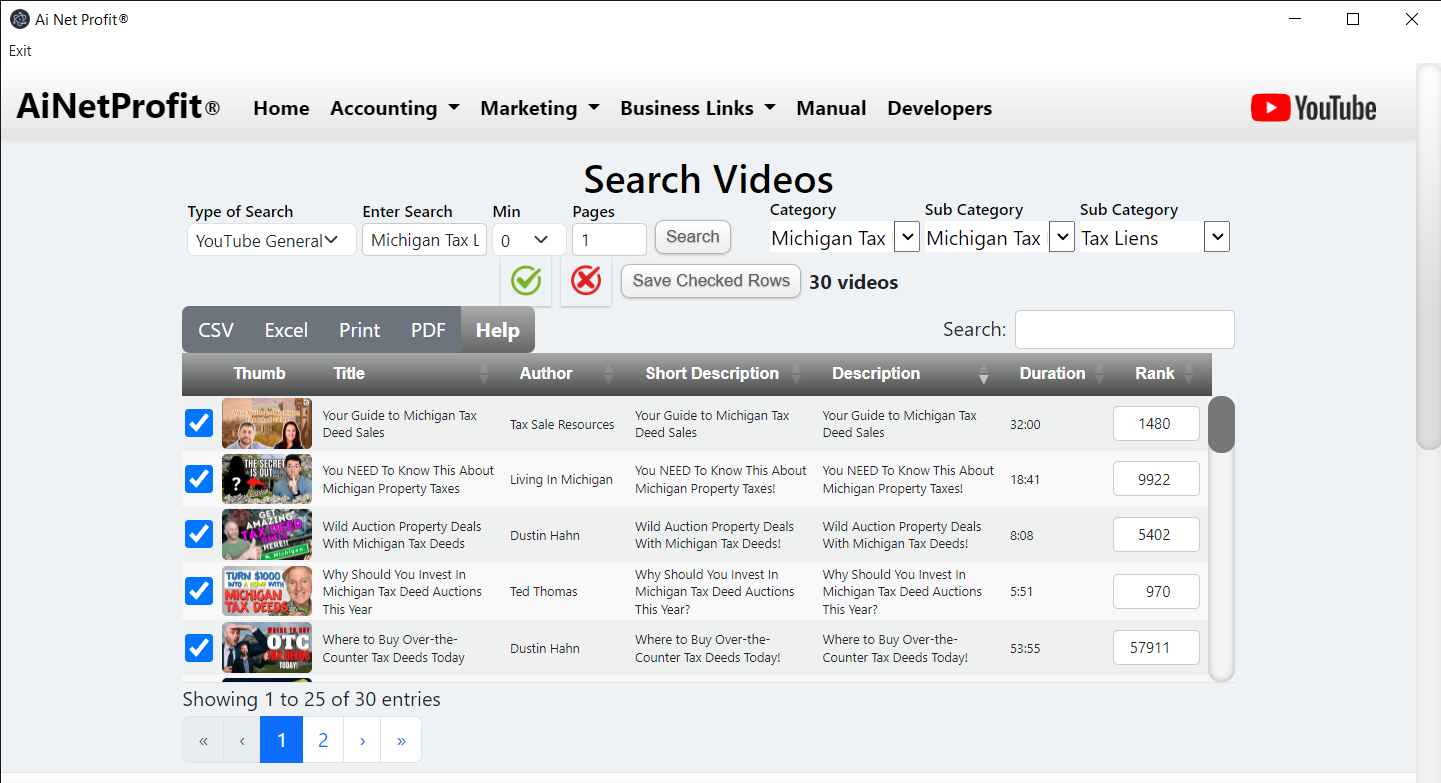

Tube Search

Why Why Did We Add Tube Search?

When running a business of any size you need information and one of the best resources for this are the tube sites like YouTube, Rumble and YouKu.Now you can search these tube sites and save the videos and websites in one placesthat you want to keep as references.

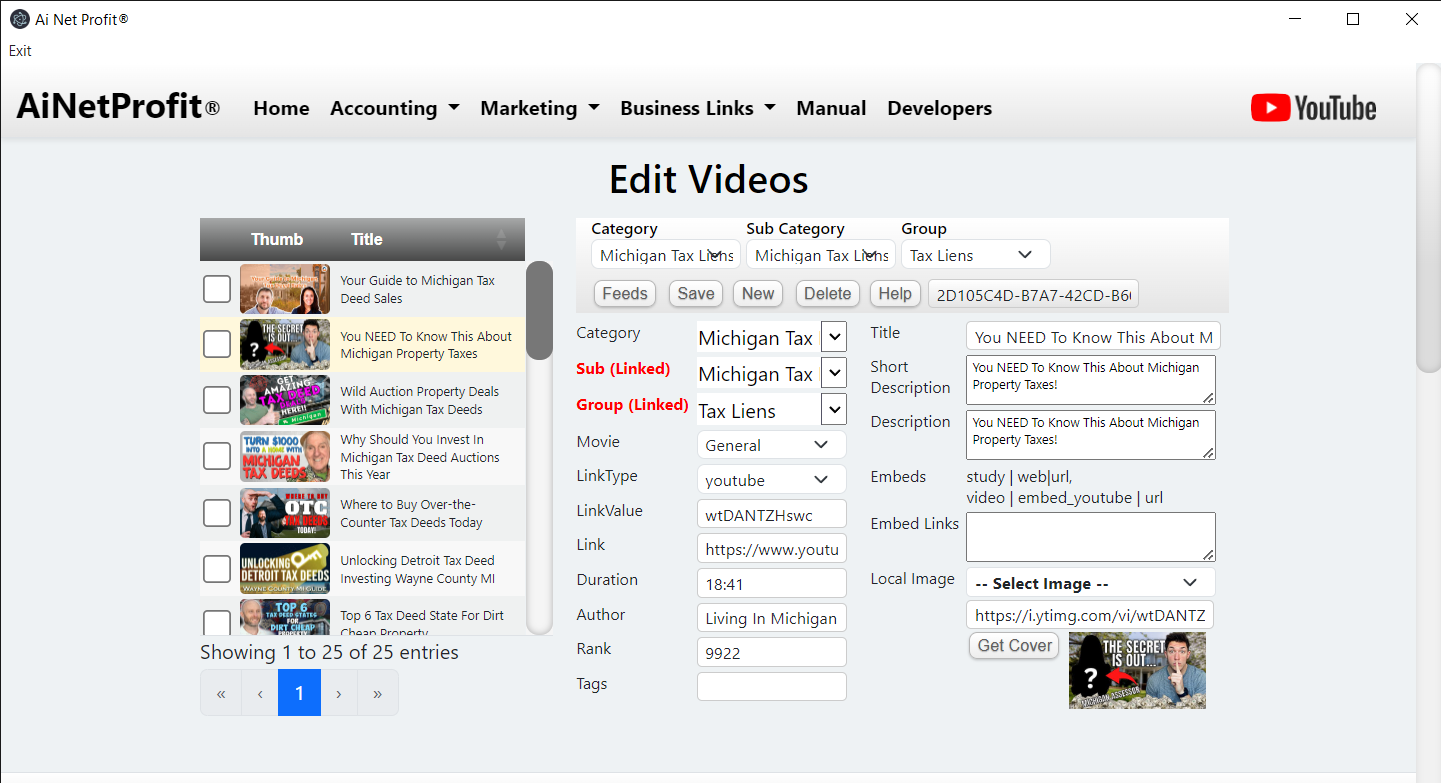

Tube Edit

Why Why Did We Add Tube Edit?

This allows you to edit the tubes and sites you saved from YouTube, Rumble and YouKu.Now you can search these tube sites and save the videos and websites in one placesthat you want to keep as references.

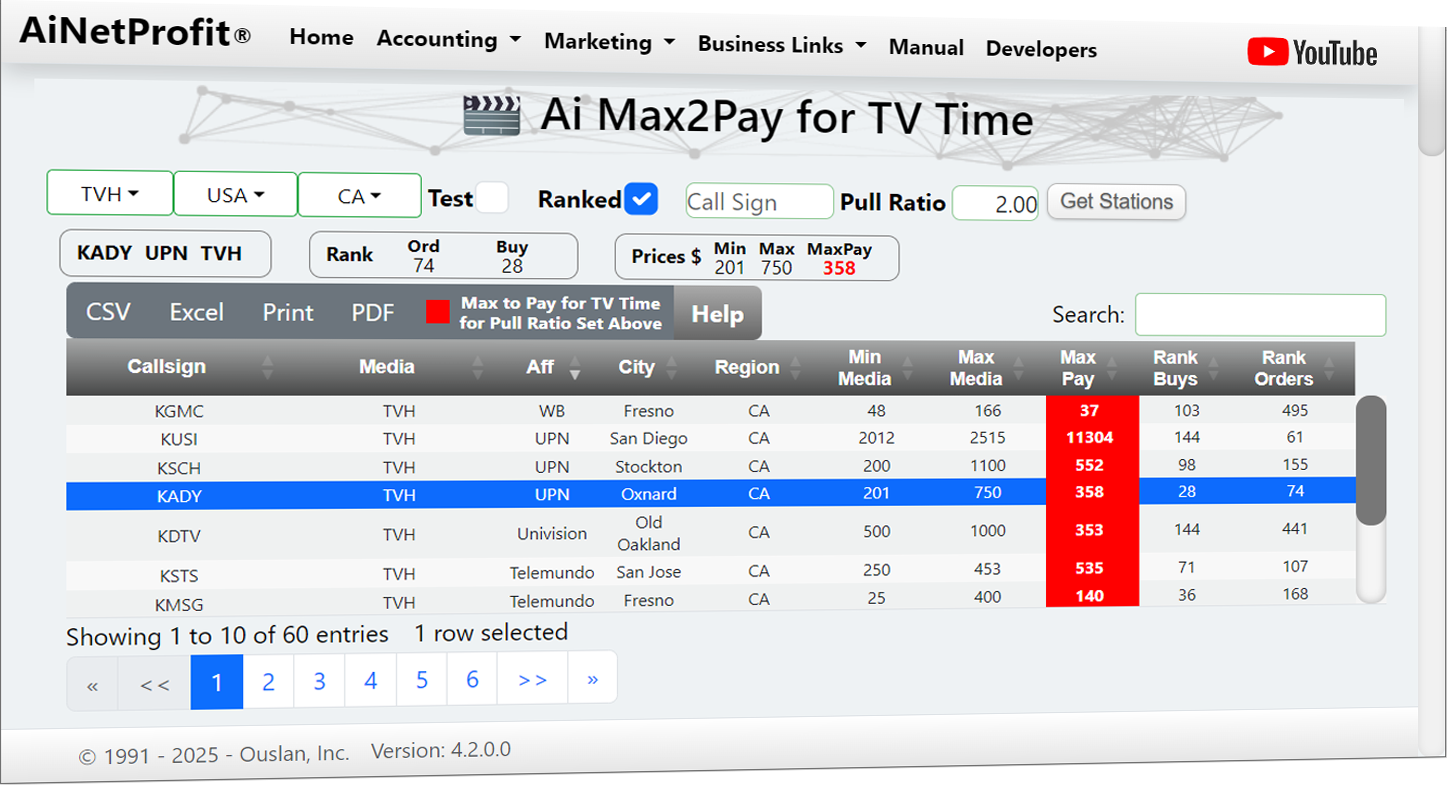

Max2Pay for TV Time

AINetProfit® show you how to buy television advertsing and gives you a deep understand of media buys on television. You might ask how OLD data we give you be useful? It os because the Pull Ratio of a half hour infomercial stays almost constant for up to one year after testing on any station. In fact the Pull ratio is pretty much for any type of ad after testing and this means youy can easily predict the probability of net profit across any collection of stations. Read more about this in our FREE Marketing Course.

We give you a database of over 1,000 broadcast and cable television media sources and detailed information we used in deciding where to air our televsion commercials and teh maximum to pay for any television time. A Pull Ratio of 2.00 is the minimum we found to breakeven with a half hour infomercial. When you enyer a Pull ratio and press the "Get Stations" button it will show you in the "Max Pay" column the maximum to bid for that half hour to achieve that pull ratio. This gave historically a way of setting a maximum bid to make for any half hour. By Federal Law the sale of all television time is defined as a "Negotiated Price Product" and it is illegal to fix prices in a rate card.

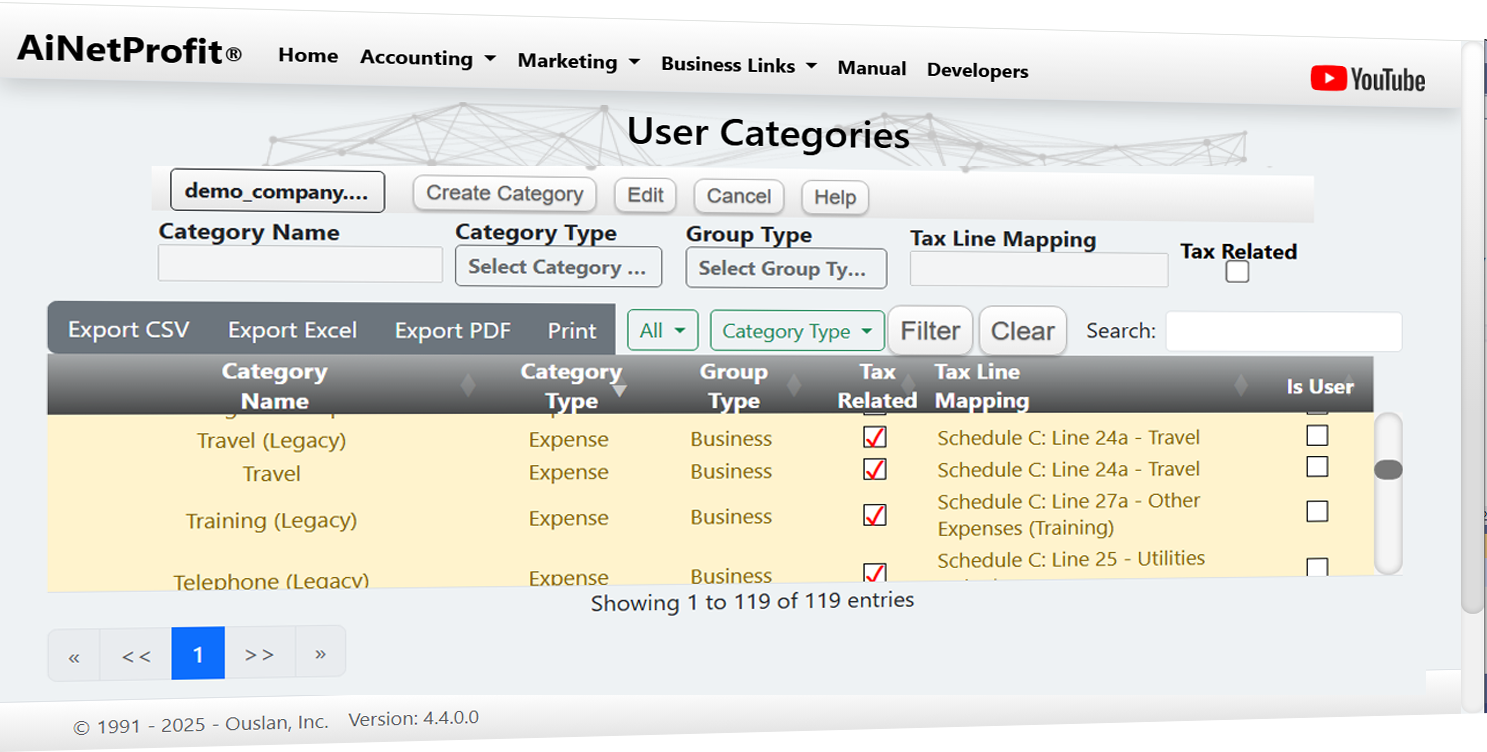

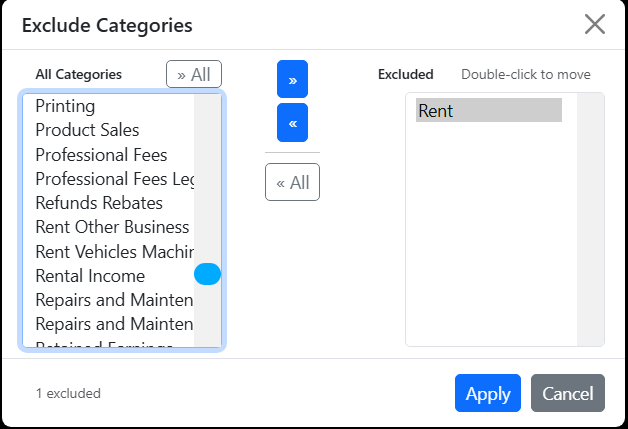

Custom Categories

AINetProfit® gives you total control over how your finances are categorized—with support for both predefined and fully custom IRS categories that reflect the real-world structure of your business. Whether you're a sole proprietor, LLC, or corporation, you can tailor your categories to match exactly how you operate.

Every taxable category in AINetProfit® can be linked directly to an official IRS tax line using our exclusive Tax Line Mapping system. This allows you to generate tax-ready reports instantly, giving your accountant clean, organized data mapped to Schedule C and other forms. It's an incredible time-saver that reduces audit risk and improves year-end tax accuracy.

Our default category library includes dozens of intelligently curated IRS-compliant options to get you started fast— all pre-mapped to real tax return lines. And unlike other software, you're not stuck with our definitions. You can edit, expand, or create entirely new categories that reflect your unique workflows and assign them to the correct tax lines with a few clicks.

This isn't just customization. It's compliance made simple. With AINetProfit®, your categories are more than just labels—they're deeply integrated with your AI engine, rules system, and financial reports to help you stay organized and audit-ready.

Why User-Defined Categories Matter

Every business is unique—and so are its expenses. That's why AINetProfit® empowers users to create their own custom categories in addition to our pre-defined set. Whether you run a design studio or sell niche products online, you can tailor your categories to match how your business actually operates.

These categories are more than labels—they drive the way your financial reports are generated, summarized, and filed. By letting users define their own

CategoryType and GroupType, the system can adapt to virtually any accounting structure, while still ensuring your data remains

organized and compliant.

IRS Tax Reporting Integration

For categories that are tax-related, we've gone one step further. Each category can be mapped to a specific line on IRS tax forms using the

TaxLineMapping field. This allows your categorized totals to be automatically aligned with the correct fields on forms such as

Schedule C, 1120, or 1065, streamlining the process of tax preparation.

For example, a category labeled "Office Supplies" might be mapped to Schedule C, Line 18. When reports are generated, AINetProfit®

calculates totals per category and displays them in the correct order, making it simple to copy the values—or export them—directly into your tax software or forms.

With our category system, you get the perfect blend of flexibility and compliance. Every category you define helps drive

smarter automation, clearer reporting, and faster tax filing. It's not just accounting—it's accounting with foresight.

And yes, the IRS would be impressed.

Pro Feature: Combine custom categories with our Category Rules Engine to auto-assign them based on transaction patterns.

ML.NET and Bayesian optimization fill in the gaps, while your custom structure stays intact—ensuring total flexibility without sacrificing automation.

Databases - Where We Store YOUR Data

AINetProfit® uses the lightweight yet powerful SQLite database engine to securely store all your financial data directly on your own computer. We believe your accounting information should remain private and in your control — not uploaded to the cloud or stored on someone else’s servers.

SQLite is a trusted, high-performance database engine used by major tech companies around the world, including Apple, Google, and Microsoft. It’s fast, reliable, and fully embedded, which means there’s no need to install or manage any external database systems — everything works seamlessly out of the box.

Note: AINetProfit® supports optional file encryption, automatic versioned backups, and full offline performance , so your data is always secure, recoverable, and accessible — even without an internet connection.

Settings - Backup YOUR Data

The Settings Screen provides a central place where users can configure and manage key aspects of the application. From here, users can view all their active databases, with each database path displayed in a copy-friendly format so it can be quickly reused elsewhere. A built-in backup feature allows users to download a ZIP archive of their data for safekeeping, while a help option links directly to the online manual for guidance. Together, these tools make the settings screen both practical and user-friendly, giving users control over their data and easy access to support while keeping configuration simple and accessible.

Our AI Trained Models

AINetProfit® leverages the power of Microsoft’s cutting-edge ML.NET framework to build and train advanced neural networks directly within the application. This allows our AI engine to continuously learn from real-world accounting patterns, optimizing decisions and enhancing accuracy over time — all without requiring an internet connection.

How Our AI-Powered Categorization Works

The system uses an AI-trained model that was built using historical transaction data. First, the training data is read from a file using

CategoryRulesLoader, which loads known examples of descriptions, transaction types, and the correct categories.

This data feeds into a machine learning model that learns how to recognize patterns and make predictions.

Once trained, the AI model is loaded by CategoryPredictor, which takes a new transaction description and type,

and returns the most likely category. The CategoryPredictionModel plays a key role in converting input data into usable

predictions by referencing the trained patterns. It effectively mimics the way a human might recognize familiar keywords in descriptions to decide

how to classify each transaction. The result is a smart categorization tool that simplifies bookkeeping

by reducing the need for manual entry.

We use real Bayesian Optimization through Microsoft's official ML.NET AutoML engine, which applies

sequential model-based optimization (SMBO) to intelligently explore and fine-tune hyperparameters such as learning rate,

tree depth, and feature encoding strategies. By combining this with our custom-built

Business Rules Engine, AINetProfit® intelligently balances predictive modeling with deterministic logic,

ensuring reliable performance and actionable insights you can trust. The result? A smarter accounting platform that gets better every time you use it.

Rules Engines

AINetProfit® leverages the power of Microsoft’s cutting-edge ML.NET framework to build and train advanced neural networks directly within the application. This allows our AI engine to continuously learn from real-world accounting patterns, optimizing decisions and enhancing accuracy over time — all without requiring an internet connection.

How Our AI and Rules Engine Work Together

ML.NET requires a certain amount of quality training data to deliver accurate results. However, in the early stages—when imported transactions are limited— AINetProfit® compensates using a built-in Category Rules Engine embedded directly within the trained model logic. This hybrid design ensures reliable categorization even with sparse data, allowing users to benefit from intelligent automation right from the start.

Our Rules Engine acts as a set of intelligent overrides based on known transaction patterns, keywords, and user-defined logic. And uniquely, we allow users to contribute their own rule definitions—but only within the Category Rules Engine. This ensures accuracy is preserved while enabling powerful customization where it matters most.

By combining AI-driven predictions with user-contributed heuristics, the system delivers the best of both worlds: the adaptability of machine learning with the transparency and precision of deterministic logic.

Behind the scenes, our architecture uses Microsoft’s AutoML and Bayesian Optimization to continuously enhance model performance

while referencing your personalized rules when training data is insufficient. This fusion of structured logic and probabilistic intelligence

is what sets AINetProfit® apart—a system built to grow with you, adapt to your workflows, and deliver actionable insights you can count on.

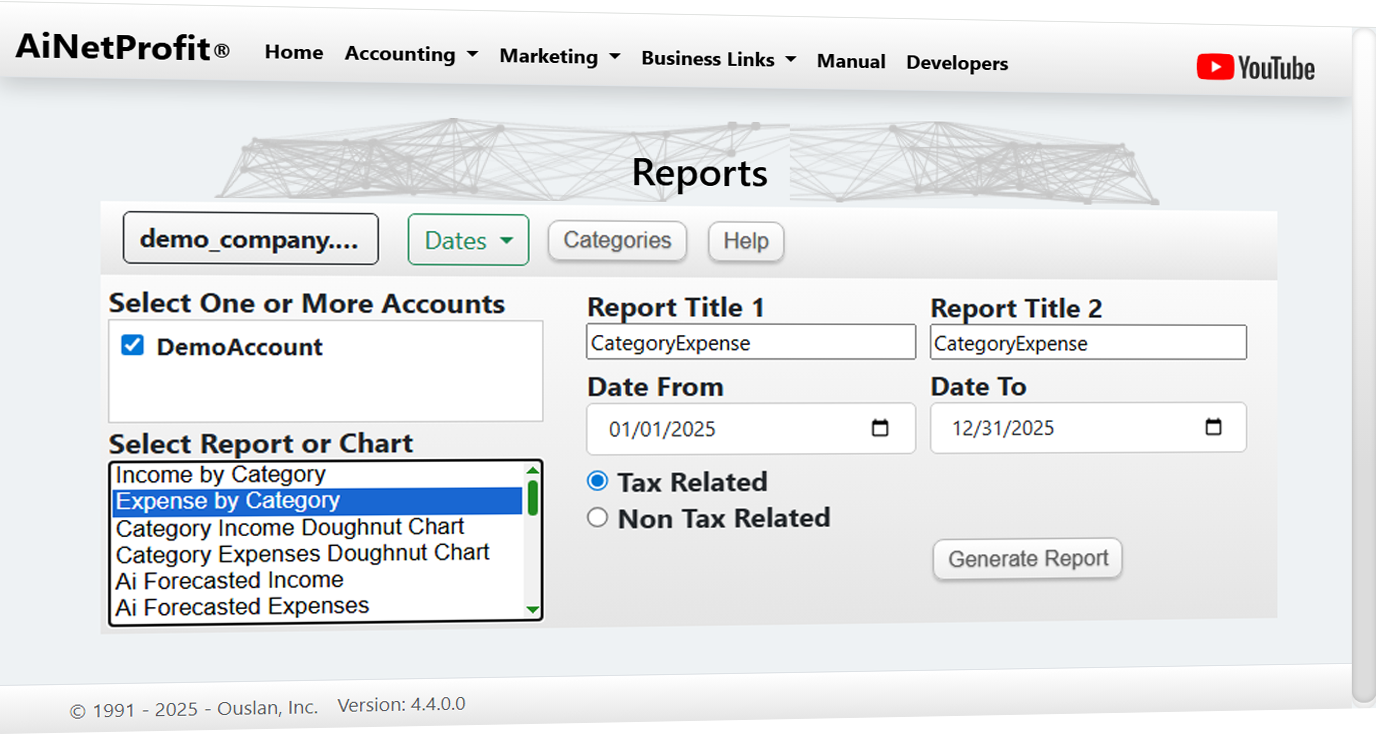

🔥 Our Custom Reports

We built our own Modern Reports Engine without using any unnecessary components like RDLC, Crystal Reports, Telerik, or DevExpress. Our reports are elegant, lightweight, and total control is in the user's hands.

- ✅ Interactive sorting, filtering, pagination

- ✅ Instant Excel, CSV, PDF, Print exports

- ✅ Fully stylable with CSS + Bootstrap

- ✅ 100% local, secure, and lightning fast

- ✅ Can easily add charts, drilldowns, tabs, anything web-based

- ✅ Add column visibility toggles with:

buttons: ['colvis'] - ✅ Add footer totals

- ✅ Add multi-level group headers

- ✅ Add custom filters by category, payee, amount

- ✅ Embed Chart.js or Google Charts to visualize totals

💡 We've Included The Standard Accounting Reports:

-

✅ Expense by Category

-

✅ Income by Category

-

✅ We will be adding a LOT more reports soon!

💡 A Few Charts We're Adding Powered by AI:

-

📈 Expense Forecast Chart

Time series forecasting usingForecastingBySsa.

Chart.js: Line chart showing actual vs predicted future expenses per category.

Table Input: Transactions (Date, Amount, Category)

// Forecast next 6 months of expenses var forecast = model.Predict(transactions); -

📊 Spending Pattern Clusters

Use K-Means clustering to group similar spending behaviors (e.g. heavy weekend spenders, recurring bill payers).

Chart.js: Radar or Bubble chart showing cluster centers.

Table Input: Transactions grouped by day, time, category, etc. -

💰 Anomaly Detection in Transactions

Use anomaly detection withRandomizedPcaorIidSpikeDetector.

Chart.js: Highlight anomalous spikes/dips in spending.

Table Input: Date, Amount, Category. -

📉 Credit Risk or Cash Flow Classification

Binary classification model predicting “low cash risk” vs “high cash risk” in upcoming weeks based on account balances + upcoming bills.

Chart.js: Gauge or pie chart showing current risk state.

Table Input: Accounts, Transactions, DueDates. -

🧠 Smart Recommendations (AI-powered Insights)

Custom model to suggest:- Items that might trigger an IRS Audit

- Categories being overused

- Potential subscriptions to cancel

- Vendors with increasing prices

-

📊 Net Profit Prediction

Regression model to predict monthly profit based on past trends.

Chart.js: Dual-axis line chart for predicted vs actual net profit over time.

Input: P&L reports aggregated by month. -

🔁 Recurring Transaction Identification

Sequence analysis or classification to detect transactions that repeat monthly.

Chart.js: Timeline chart showing recurring expenses.

Input Table: Transactions with date/amount/payee.

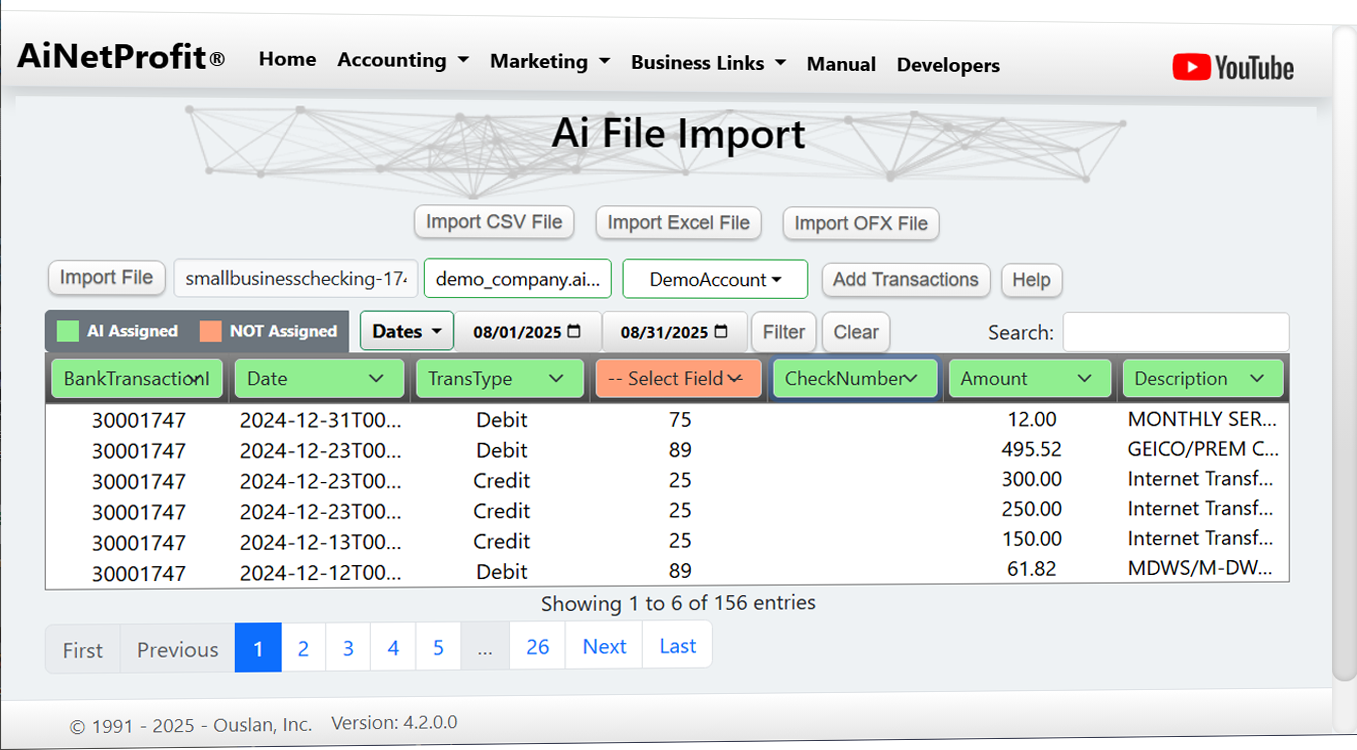

Import Screen

This is where our AI Neural Network really helps to make importing financial statements easy.

Using AI to map IRS tax categories to imported financial data helps automate one of the most tedious and error-prone tasks in accounting. By analyzing descriptions, amounts, and transaction patterns, AI can accurately assign the correct IRS categories such as "Office Expenses," "Advertising," or "Meals & Entertainment"—saving time, reducing manual errors, and ensuring compliance with tax reporting requirements.

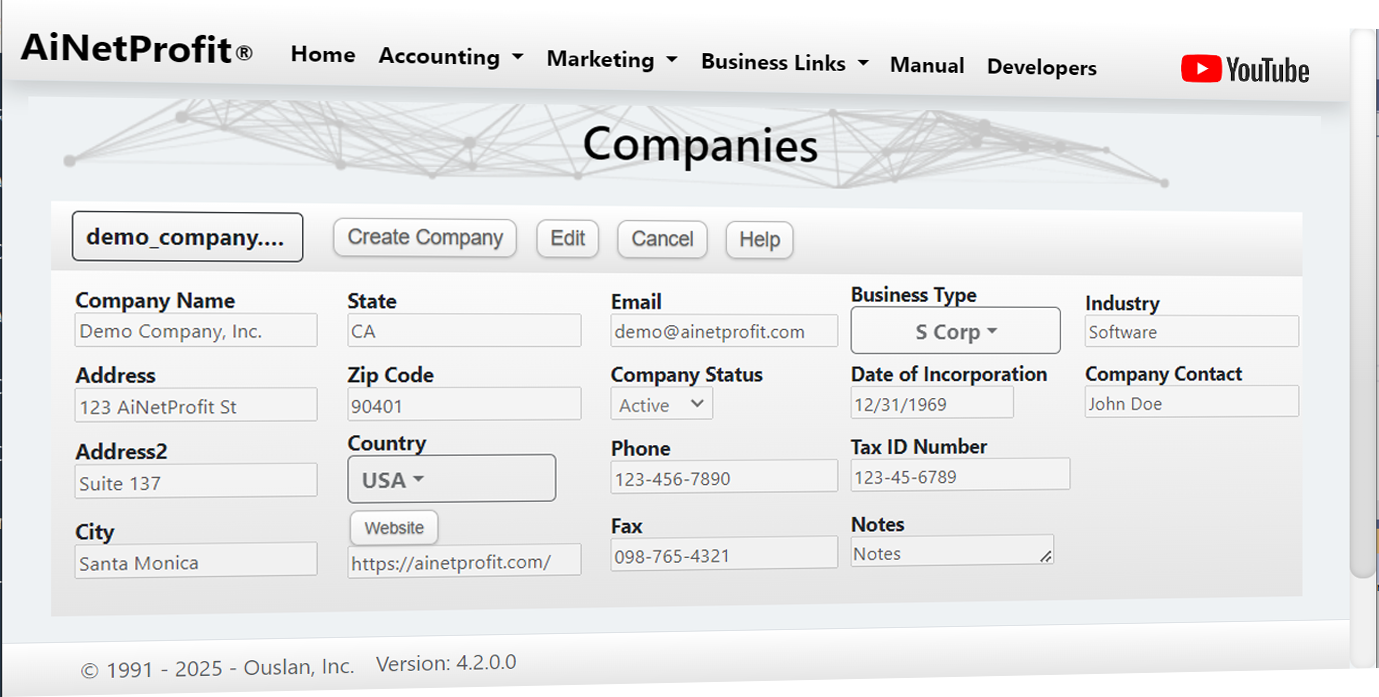

What Is A Company?

The first screen you will see after our cool-looking splash screens is the "Company" screen below where you create your taxable entities. Each Company has it's own, unique database.

A company, from a tax perspective, is a distinct taxable entity recognized

by the government. It can take the form of a formal business structure like a

corporation (Inc. or Corp), a limited liability company (LLC),

a "doing business as" (DBA), or even an individual operating as a sole proprietor.

Regardless of form, any entity that earns income and engages in commerce is subject

to taxation. Like individuals, these entities must report income, deduct expenses,

and pay taxes according to federal, state, and local tax laws. The key point is that

the IRS treats all income-generating entities—whether businesses or individuals—as

taxable entities.

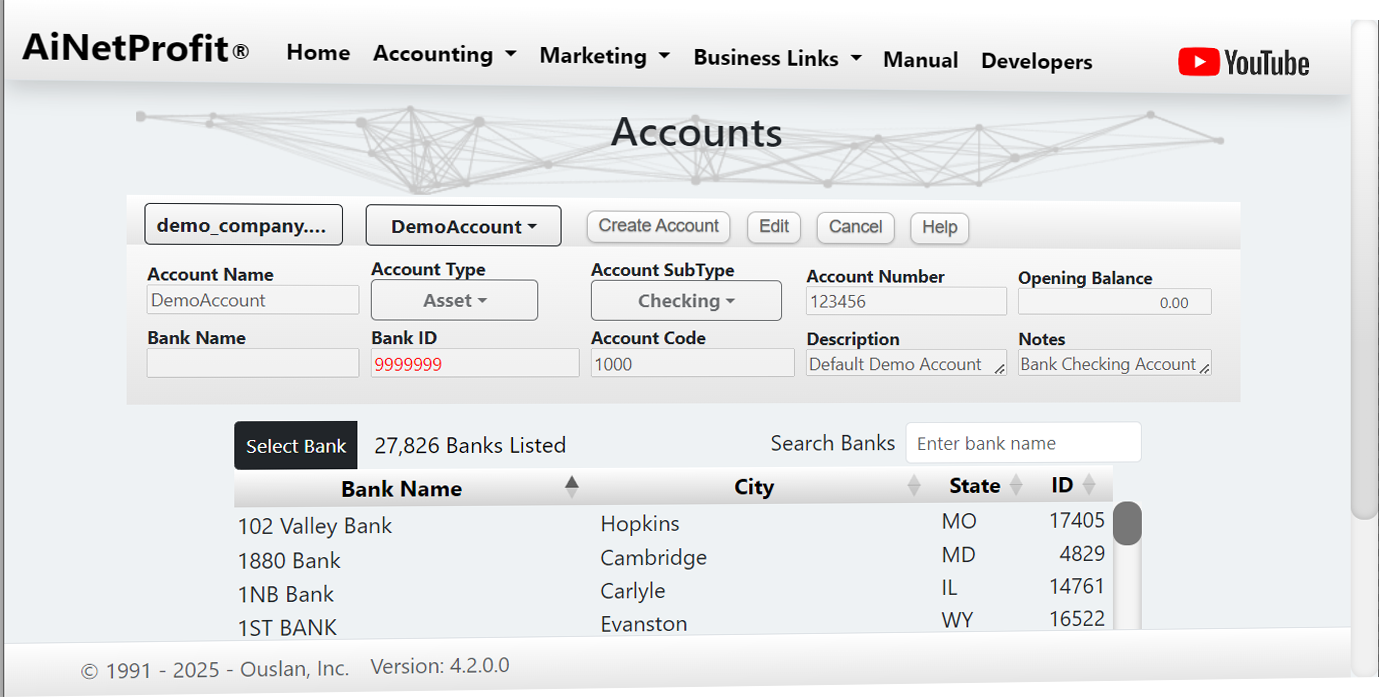

Accounts Screen

After you create a company you will need then to add your accounts that your company hass that including bank accounts, investment accounts, etc.. Our database gives you a list of 27,826 banks to choose from. And you can add other typoes of financial accounts from credit cards to mutual funds.

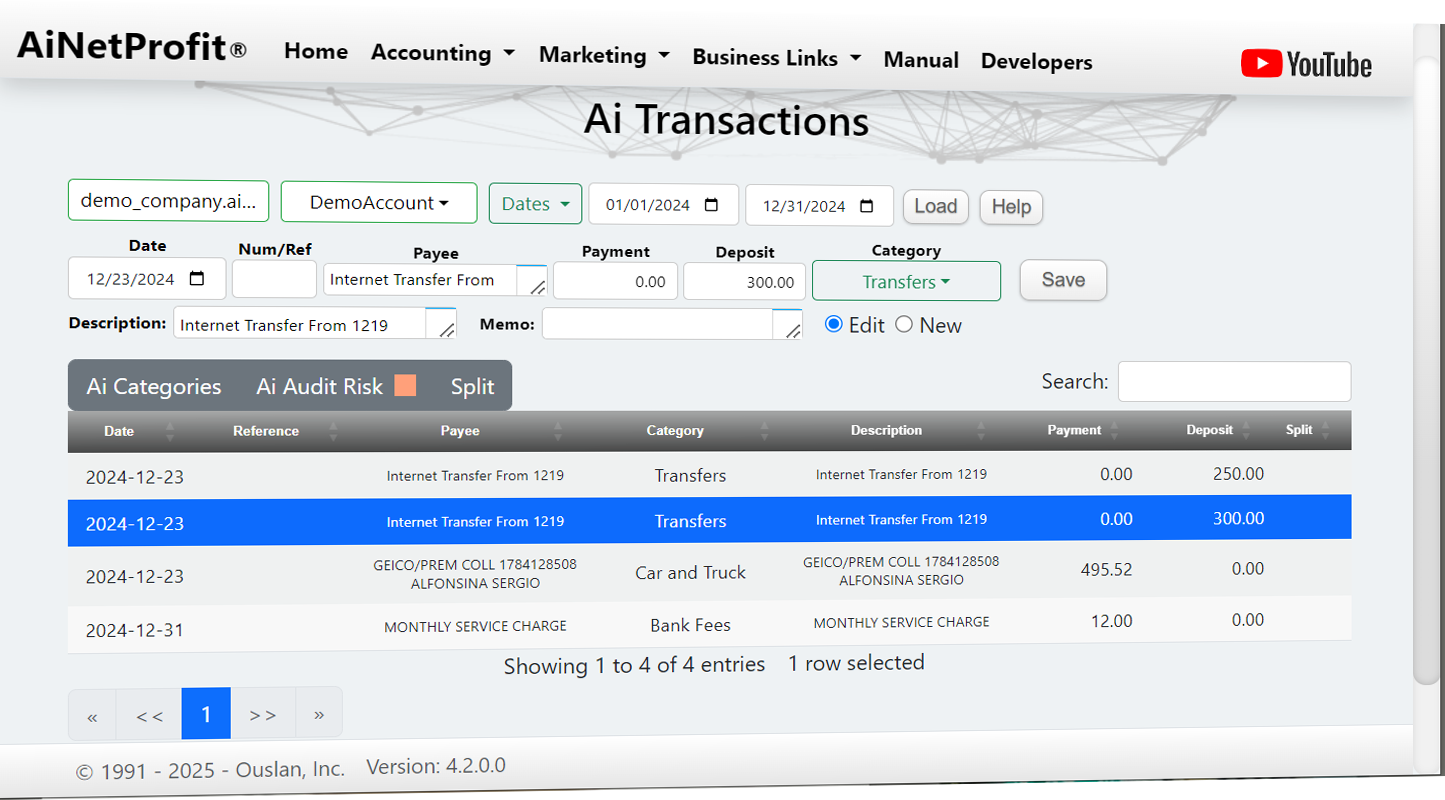

Transactions Screen

This is where our AI Neural Network really helps to manage your tranactions.

The Transactions Screen uses AI to automatically match IRS tax categories to your imported financial data. By analyzing transaction descriptions, amounts, and patterns, the system intelligently classifies expenses into categories like “Advertising,” “Office Expenses,” or “Meals & Entertainment.” This dramatically reduces manual effort, eliminates common errors, and helps ensure accurate, compliant tax reporting.

Section 7

Content for section 7.

Section 8

Content for section 8.

Section 9

Content for section 9.

Section 10

Content for section 10.

Section 11

Content for section 11.

Section 12

Content for section 12.

Section 13

Content for section 13.

Section 14

Content for section 14.

Section 15

Content for section 15.

LEGAL NOTICE

.aidb® — The .aidb file extension is a registered trademark of Ouslan, Inc., used since 1991. All rights reserved worldwide.

|

This image is the official registered trademark icon and

logo for AiNetProfit®. All rights reserved worldwide. |

Disclaimer

The information provided on this website is for general informational purposes only and is not intended to constitute legal, professional, or technical advice. All content is provided "as is" without any warranties of any kind, either express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose, or non-infringement.

While we strive to provide accurate and up-to-date information, ainetprofit.com does not guarantee the completeness, accuracy, or reliability of the information provided. Users are solely responsible for any reliance they place on such information.

Articles, tutorials, and code samples featured on this website reflect the opinions and views of their respective authors and do not necessarily represent the views or opinions of Software-rus.com or its affiliates and ainetprofit.com assumes no liability for any loss or damage caused by the use or misuse of any software, information or code provided.

This website may include links to external websites for additional information or convenience and ainetprofit.com is not responsible for the content, accuracy, or availability of these external sites and does not endorse the views expressed on them.

By using this website, you agree to indemnify and hold harmless Software-rus.com, its owners, contributors, and affiliates from any claims, damages, or costs arising from your use of the site or the content therein.